Card / Account Holders and Approving Officials Travel Training

Travel Training

Introduction: Welcome to the Course

Welcome to the GSA SmartPay® Travel Training for Card/Account Holders and Approving Officials

As a federal government employee going on official government travel, you are expected to be familiar with the Federal Travel Regulations (FTR) and other government travel policies.

This training course is intended to teach you the basics about your roles and responsibilities as a card/account holder or approving official and can be used as refresher training as required by your agency. We encourage you to also learn about your agency’s specific travel program requirements and policies. After reviewing each lesson, click on the button to go to the next lesson. The quiz is only available on the website and can be accessed after you complete the final lesson.

Note: The GSA SmartPay training website is an independent training system and does not connect/communicate with any other agency training systems.

Lesson 1: Travel Program Overview

What is the GSA SmartPay® program?

Established in 1998, the GSA SmartPay program is the world’s largest government charge card and commercial payment solutions program, providing services to more than 250 federal agencies/organizations and Native American tribal governments with 4.5 million total accounts. GSA SmartPay payment solutions enable authorized government employees to make purchases on behalf of the federal government in support of their agency’s mission. The GSA SmartPay program includes the following business lines:

- GSA SmartPay Purchase.

- GSA SmartPay Travel.

- GSA SmartPay Fleet.

- GSA SmartPay Integrated.

Through the Master Contract with multiple banks, the GSA SmartPay program enables agencies/organizations across the federal government to obtain payment solutions to support mission needs. The Master Contract, administered by GSA, is a fixed price, indefinite delivery, indefinite quantity (IDIQ) contract. The maximum base period for the initial order is four years with three, three-year options.

Agencies/organizations issue a task order under the GSA SmartPay 3 Master Contract to one of the GSA SmartPay contractor banks – Citibank or U.S. Bank. Then, the awarded bank provides payment solutions to the agency.

Through the task order, your agency/organization program coordinator (A/OPC) sets up accounts for the card/account holders, manages the accounts using the bank’s Electronic Access System (EAS), and resolves issues or questions by working directly with a bank representative.

Specific to travel, the GSA SmartPay program provides card/account holders with a means to pay for all travel and travel-related expenses. Additionally, the GSA SmartPay program is the primary mechanism used to purchase airline, rail, and bus tickets at significantly reduced fares under the GSA City Pair Program (CPP).

What are the benefits to using the GSA SmartPay Master Contract for obtaining payment services?

The GSA SmartPay program has continued to grow through increased adoption as agencies/organizations realize benefits afforded under the program.

Utilizing the GSA SmartPay Master Contract means:

- A faster contract acquisition process and reduced risk of protest, as compared with a full and open competitive procurement.

- Favorable negotiating platform and contract terms.

- Awards to contractor banks based on a competitive bidding process.

- Established relationships with contractor banks.

- A broad range of flexible products and services for agencies/organizations as well as the flexibility to add products and services.

- Ongoing support for your agency/organization.

What are some of the overall benefits to using the GSA SmartPay program?

Agency Refunds

Agencies have the opportunity to earn refunds based on the dollar volume of transactions and the speed of payment.

Safety and Transparency

The GSA SmartPay program provides secure solutions for efficient payment transactions. Customers also have access to tools that provide increased transparency for spend and performance data.

Electronic Access to Data

Through the GSA SmartPay contractor bank’s electronic access system (EAS), account managers and card/account holders have immediate access to complete transaction-level data, helping to mitigate fraud, waste, and abuse.

Worldwide Acceptance

Through the use of commercial payment infrastructure, customers are able to use GSA SmartPay solutions anywhere in the world where merchants accept cards.

Identification for Discount Programs

GSA SmartPay solutions provide automatic point-of-sale recognition for many GSA discount programs, including Federal Strategic Sourcing Initiative (FSSI), the GSA City Pair Program (CPP), and more.

Other Benefits

GSA SmartPay payment solutions provide other less tangible benefits including travel insurance and eliminating the need for imprest funds or petty cash at the agency.

Why does the U.S. Government have a travel payment solutions program?

The Travel and Transportation Reform Act of 1998 (Public Law 105-264) [PDF, 9 pages] mandates that federal government card/account holders use the travel card/account for official government travel expenses. Additionally, the Federal Travel Regulation (FTR) mandates use of the travel card/account in almost all cases (see FTR Subpart H §301-70.700 for exemptions). The travel card/account allows individual card/account holders to pay for travel expenses and receive cash advances. In many instances, use of the travel/card account eliminated the need for agencies to issue travel cash advances. Government card/account usage provides streamlined, best-practice processes that are consistent with private industry standards.

What are some types of GSA SmartPay Travel cards/accounts?

Individually Billed Accounts (IBAs)

- Most common travel card/account.

- Issued to an employee designated by the agency/organization in the employee’s name.

- Used to pay for official travel and travel-related expenses.

- Only issued to federal employees or employees of tribes or tribal organizations.

- May be used for local travel only if authorized by written policy of the agency/organization.

- Agencies/organizations reimburse employees only for authorized and allowable expenses.

- Card/account holders are directly responsible for all purchases charged to the IBA account.

- Payment may be made directly by the card/account holder, agency/organization or in the form of a split disbursement in accordance with agency/organization policy.

Centrally Billed Accounts (CBAs)

- Established by the bank at the request of the agency/organization to pay for official travel charges and official travel-related expenses.

- Generally used to purchase common carrier transportation tickets for employee official travel through third-party arrangements, such as the GSA E-Gov Travel Service (ETS) for civilian agencies, the Defense Travel System (DTS) for the Department of Defense or permissible equivalent travel system.

- Agencies/organizations may also make purchases through their Travel Management Centers (TMCs), commercial travel offices and through other government contracts.

- Agency is directly billed and is liable for making the payment.

- Payment is made directly to the bank by the government.

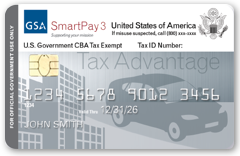

Tax Advantage Travel Accounts

- Issued to an employee designated by the agency/organization in the employee’s name.

- Used to pay for travel and travel-related expenses.

- Combines IBA and CBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses.

- Charges for rental cars and lodging will be automatically billed to a CBA for payment, taking advantage of the government’s CBA tax exemption status for those types of accounts.

- Charges for other travel-related purchases, such as meals and incidentals, are billed to the IBA portion of the account and will still incur tax. The individual traveler will still be liable for payment to the bank for those charges.

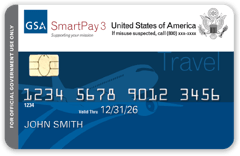

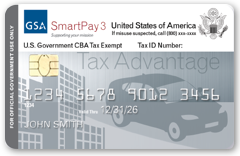

How do I recognize GSA SmartPay Travel cards/accounts?

Typically, travel cards have one of these designs:

Please note that card designs may vary.

GSA SmartPay Travel cards/accounts use the following prefixes:

| Brand | Card Prefix |

|---|---|

| Mastercard | 5565, 5568 |

| Visa | 4486, 4614, 4615, 4716 |

For the travel business line only, the sixth digit will identify whether the account is a CBA or IBA.

| Account Type | Sixth Digit | Billing Type |

|---|---|---|

| 1, 2, 3, 4 | IBA |

| 6, 7, 8, 9, 0 | CBA |

| 5 | CBA/IBA |

Why is it important to understand your travel card/account type?

Tax exemption and liability differ depending on the travel card/account type.

Tax exemption considerations

- All GSA SmartPay CBAs should be exempt from state taxes.

- Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states.

- Card/account holders should review and understand the state tax policy for the state where you will be traveling to and should make sure to have all necessary forms before traveling.

Liability considerations

IBA Accounts

- Liability for charges on the IBA rests with the individual card/account holder, not with the agency/organization.

- If the card/account holder fails to pay his/her account on a timely basis, the bank may suspend or cancel the account and assess late charges and fees.

- If the bank cancels an account due to delinquency, the bank may report that information to credit bureaus and the information will appear on the card/account holder’s personal credit report.

- The bank can pursue debt collection to obtain repayment of the charges.

- The agency/organization is never responsible or legally liable for the account.

CBA Accounts

- Liability for charges on the CBA rests with the agency/organization, not with the individual card/account holder.

Tax Advantage Travel Accounts

- Because the account is a combination of both CBA and IBA, the liability will be determined by the type of purchase.

- If it is a CBA purchase, the liability rests with the government.

- If it is an IBA purchase, the liability rests with the card/account holder.

How would someone check tax exemption status?

Here is a typical example of how to check tax exemption status:

- Jo is planning an official government trip to the GSA SmartPay Training Forum in Orlando, Florida.

- During the planning stages for the trip, she checks the GSA SmartPay website to find out more information about tax exemption in Florida.

- Jo learns that IBA travel cards/accounts are tax exempt in Florida. In addition, while no form is required, Florida does allow hotels to require a “Certificate of Exemption”. She also saved the Florida Department of Revenue’s phone number in case any questions came up during her trip.

- Jo confirms that she has a GSA SmartPay IBA travel card/account – the first four digits are “4486” and the 6th digit is a “4”.

- Jo books the hotel room and follows up with a call to verify that the hotel is compliant with the state’s tax exemption policy. If not, she’s given herself plenty of time to find another hotel that does comply.

Lesson 2: Key Participants

Who are the key participants in the GSA SmartPay® program within my agency/organization and what are their responsibilities?

Agency/Organization Program Coordinators (A/OPCs)

- Overall management and oversight of the cards/accounts under their span of control.

- Set up cards/accounts and designate authorization controls.

- Serve as a liaison between card/account holders and the bank.

- Provide ongoing advice and assistance to card/account holders.

- Develop agency program procedures and policies as necessary.

- Audit cards/accounts as required by the agency’s policy.

- Use the bank’s Electronic Access System (EAS) to perform account management and oversight.

Approving Officials (AO)

- Typically the card/account holder’s supervisor.

- Assure proper use of the card/account.

- Determine if purchases are necessary for accomplishing the mission of the agency.

Card/Account Holders

- Designated by an agency/organization to receive a card/account.

- Secure the payment solution.

- Maintain records relating to transactions, as required.

- Use the card/account ethically for official government purposes only.

Designated Billing Offices (DBO)

- Serve as the focal point for receipt of official centrally billed invoices.

- Oversee the proper processing of invoices.

- Ensure invoices are paid within the Prompt Payment Act timeframes.

Transaction Dispute Officers (TDO)

- Assist the agency/organization and the bank in tracking and resolving disputed transactions.

EC/EDI Offices (EO)

- Focal point for electronic commerce/electronic data interchange (EC/EDI) for the agency/organization.

- Oversee the proper implementation of the EC/EDI capabilities and processes.

Who are the key participants in the GSA SmartPay program that are outside of my agency/organization and what are their responsibilities?

Contractor/Issuing Banks

- Enable merchant payments for purchase transactions.

- Establish cards/accounts.

- Issue cards, if required.

- Prepare the monthly statement for each card/account holder.

- Issue invoices to the Designated Billing Offices (DBO).

- Provide 24-hour customer service.

- Prepare reports that assist the agency in effectively utilizing the program.

- Examples include Citibank and U.S. Bank.

Brands

- Financial institutions that dictate where payments can be processed.

- Facilitate the payment process between card/account holders, merchants, and issuing financial institutions.

- Examples include Visa and Mastercard.

Merchants

- Source for supplies or services.

- May be a required source inside or outside the government, another government agency, or a private sector merchant.

GSA Contracting Officer

- Administers the GSA SmartPay Master Contract on behalf of all authorized users, including your agency/organization.

- Make changes to the GSA SmartPay Master Contract requirements.

- Legally commit or obligate the government to the expenditure of public funds for the GSA SmartPay Master Contract.

- Render a final decision on a dispute pertaining to the GSA SmartPay Master Contract.

Is there anyone else who will be involved with the GSA SmartPay program?

Because the GSA SmartPay program is a highly visible program and receives a lot of interest both within and outside your agency/organization, your agency/organization’s management, the Inspector General (IG) staff and other investigators/auditors will likely be interested in the performance of the travel program. Many agencies/organizations will have periodic audits of the travel program and your A/OPC will likely be a key player in those audits. Additionally, you may find that the Office of Management and Budget (OMB) and Congress take an interest in the performance of your program.

Lesson 3: Travel Card/Account Use

What is the appropriate use of the GSA SmartPay® Travel card/account?

The GSA SmartPay Travel cards/accounts may be used ONLY for authorized official travel and travel-related expenses. Official travel expenses are broadly categorized as transportation, lodging, meals and incidentals.

The travel card/account must not be used for personal expenses unrelated to official government travel. This is considered to be misuse of the account or use of a federal payment solution by an authorized user for other than the official government purpose(s) for which it is intended.

To help prevent misuse, the travel card/account may be electronically coded to be rejected at merchant locations that your agency has determined are not necessary for conducting official government business.

Some agencies allow the GSA SmartPay Travel card/account to be used for local travel.

Here’s an example of local travel use:

Sarah is traveling to a training class in Washington, D.C., which is located within the vicinity of her regular duty station. To attend the event, she must either take a taxi or public transportation. Official government travel authorization is not provided or necessary for this class. However, Sarah is able to use her GSA SmartPay Travel card/account because her agency policy has authorized employees to use their IBA travel card for local travel and related expenses.

How does the GSA SmartPay Tax Advantage Travel card/account work?

The Tax Advantage Travel card/account is issued to an employee designated by the agency/organization in the employee’s name.

Agency/organization program coordinators (A/OPCs) will work with their contractor bank to identify Merchant Category Codes (MCCs) for rental cars and lodging to be excluded from taxes.

Accounts will be established using IBA procedures, to include credit checks or other creditworthiness assessments.

When the card/account is used, invoices will be sent to the employee and the agency/organization for payment via split disbursement.

The CBA portion of the charges will be paid by the agency and the IBA portion of the charges will be the responsibility of the employee.

Agencies/organizations must specify invoice elements in their task order level requirements.

Here’s an example of Tax Advantage Travel card/account use:

Andrew is on official government travel and is checking into the hotel using his Tax Advantage Travel card/account. The process does not change from how hotel merchants run the card and verify tax exemption status today. The hotel will need to verify (through use of the 6th digit and the BIN) that the payment is being directly provided by the government through the CBA function. Once verified, Andrew will provide any required CBA forms to the hotel. Required forms vary from state to state and can be found on the GSA SmartPay website. Even if the state does not exempt taxes for the IBA transactions today, it is still required to exempt all of the CBA transactions. At the end of the month, when Andrew receives his invoice from the bank, the hotel should already be paid for through his agency’s CBA process. He will just need to pay for his meals and incidentals.

Are there exceptions to using the GSA SmartPay Travel card/account while on official travel?

Yes, exceptions to using the GSA SmartPay Travel card/account include:

- The vendor does not accept the payment solution.

- The GSA Administrator granted an exemption (FTR Subpart H §301-70.700).

- Your agency head granted an exemption.

The GSA SmartPay Travel card/account may be used for authorized official travel and authorized travel-related expenses ONLY. Official travel expenses include transportation, lodging, meals and incidentals. The travel card/account will be printed in the cardholder’s name and must not be used by any other person. The cardholder is personally liable for all charges made on their travel card/account. They should not use their government travel card/account for any personal expenses.

What is Section 889 and how does it apply to purchases?

Section 889 of the John S. McCain National Defense Authorization Act (NDAA) for Fiscal Year 2019 (P.L. 115-232 [PDF, 789 pages]) and the Federal Acquisition Regulation (FAR) Case 2018-017 prohibit the purchase of covered telecommunications equipment and services from merchants who sell products containing spyware. These devices could pose a threat to U.S. security by spying on or disrupting communications within the U.S. Therefore, GSA SmartPay card/account holders should follow their agency’s policy regarding Section 889 compliance.

What is the FASCSA Order Check?

Before making any purchase, buyers should review Federal Acquisition Supply Chain Security Act (FASCSA) orders.

The federal government issued an interim rule that amends the Federal Acquisition Regulation (FAR) to implement supply chain risk information sharing and FASCSA orders. This rule became effective on December 4, 2023.

Accessing FASCSA Orders

The System for Award Management (SAM) is an official website of the U.S. Government that helps users navigate the federal award lifecycle.

The site stores FASCSA order data entered by the Department of Homeland Security (DHS), the Department of Defense (DoD), and the Director of National Intelligence (DNI).

Before making any purchase, including GSA SmartPay Purchase card/account transactions, agency officials should go to SAM.gov and select the “View FASCSA Orders” button to download and review a complete list of the FASCSA orders.

Buyers should:

- Be sure to follow their agency rules and procedures for compliance with applicable FASCSA orders to determine whether the purchase should be made.

- Keep in mind that the FASCSA order review should take place for all purchases at any dollar threshold.

- Note that until DHS, DoD, or DNI create the first FASCSA order in SAM.gov, the downloaded file will be empty.

What is the American Security Drone Act Of 2023?

On December 22, 2023, the President signed the National Defense Authorization Act for Fiscal Year 2024 (NDAA).

As part of the NDAA, Sections 1821 and 1826 contain prohibitions on using the GSA SmartPay purchase card to buy any covered unmanned aircraft systems from covered foreign entities.

Section 1821 - THE AMERICAN SECURITY DRONE ACT OF 2023

Section 1822 - Defines covered foreign entities and covered unmanned aircraft systems.

The term COVERED FOREIGN ENTITY means an entity included on a list developed and maintained by the Federal Acquisition Security Council and published in the System for Award Management (SAM). This list will include entities in the following categories:

- An entity included on the Consolidated Screening List.

- Any entity that is subject to extrajudicial direction from a foreign government as determined by the Secretary of Homeland Security.

- Any entity the Secretary of Homeland Security, in coordination with the Attorney General, Director of National Intelligence, and the Secretary of Defense, determines poses a national security risk.

- Any entity domiciled in the People’s Republic of China or subject to influence or control by the Government of the People’s Republic of China or the Communist Party of the People’s Republic of China, as determined by the Secretary of Homeland Security.

- Any subsidiary or affiliate of an entity described in subparagraphs (A) through (D).

- The term COVERED UNMANNED AIRCRAFT SYSTEM has the meaning given the term ‘‘unmanned aircraft system’’ in section 44801 of title 49, United States Code.

Section 1826 - PROHIBITION ON USE OF GOVERNMENT-ISSUED PURCHASE CARDS TO PURCHASE COVERED UNMANNED AIRCRAFT SYSTEMS FROM COVERED FOREIGN ENTITIES

- Effective immediately, Government-issued Purchase Cards may not be used to procure any covered unmanned aircraft system from a covered foreign entity.

Cleared Drone Vendors

- A cleared list of drone vendors is available from the Defense Innovation Unit.

- https://www.diu.mil/blue-uas-cleared-list

Lesson 4: Obtaining a Travel Card/Account

How do I apply for a GSA SmartPay® Travel card/account?

To apply for a GSA SmartPay Travel card/account, prospective applicants should:

- Contact the travel A/OPC at your agency to obtain an application and submit the necessary information for the GSA SmartPay Travel card/account.

- Provide an address (typically your home address) where a GSA SmartPay Travel card should be mailed.

- Keep on hand the identifier to activate your travel card/account.

- Talk about ATM access with your A/OPC.

- Know and understand your responsibilities in accepting a GSA SmartPay Travel card/account. Be aware that:

- You are personally liable and responsible for all charges whether or not you are reimbursed by your agency.

- Your credit rating may be affected if the card/account is canceled.

- You may be subject to disciplinary action and/or salary offset for late payment.

- Sign and submit the application. Most agencies also require a supervisor’s signature.

Am I required to have a creditworthiness assessment before receiving a card/account?

A creditworthiness assessment is used as an internal control to ensure that card/account holders are financially responsible. If you are a new travel card/account applicant, then your agency is required to assess your creditworthiness in accordance with Public Law 112-194 (Government Charge Card Abuse Prevention Act of 2012) [PDF, 7 pages] before a card/account is issued.

In some cases, a restricted card/account may be issued if the applicant has a low creditworthiness score or refuses a credit check. A restricted card includes constraints such as:

- Reducing the limit on individual transaction amounts.

- Limiting the types of transactions allowed.

- Issuing a declining balance card that automatically restricts dollar amount and transaction types.

- Limiting the dollar amount of transactions that can be applied to the card within a particular time period.

- Limiting the length of time a card remains active, such as for the length of time the card/account holder is in official travel status.

- Restricting use at ATMs.

Please contact your agency/organization program coordinator (A/OPC) for your agency-specific process for assessing creditworthiness.

When will I receive my GSA SmartPay Travel card/account?

New applicants should receive their GSA SmartPay Travel card/account from the contractor bank to the address provided in your application within 10–14 calendar days from the time the application is submitted by your A/OPC.

Replacements for lost, stolen, broken or otherwise unusable cards will be sent within 48 hours of the agency/organization request.

In the case of an emergency, such as response to a natural disaster, threat to national security, and military mobilization, the contractor bank will send a GSA SmartPay Travel card within 24 hours of the request.

If you have ATM authorization, the contractor bank will mail the PIN for your ATM separately. Typically, you should receive the PIN within a few days after receiving your travel card/account; however, you may receive the PIN before you receive the travel card/account.

When you receive your GSA SmartPay Travel card/account:

- Read the Cardholder Agreement.

- Sign the back of your GSA SmartPay Travel charge card, if applicable.

- Activate your GSA SmartPay Travel card/account.

- Secure your GSA SmartPay Travel card/account until you are ready to travel.

- Read and understand your agency specific travel policy and procedures.

- Find out what documents or receipts you will need to keep.

- For civilians, become familiar with the Federal Travel Regulation (FTR) - 41 Code of Federal Regulations (CFR), Chapters 300-304.

- For DoD employees, become familiar with the Joint Travel Regulations (JTR).

- For U.S. Department of State Foreign Service members, become familiar with the Foreign Affairs Manual (Volume 4, Chapter 460 (4 FAM 460) and Volume 14, Chapter 500 (14 FAM 500)).

Lesson 5: Planning for the Trip

How do I complete a Travel Authorization (TA)?

The first step to planning for official government travel is to determine:

- The purpose of the trip.

- Length of time you will be on travel.

- Destination(s).

- Dates of departure/return.

- Whether a vehicle will be needed while at your destination.

Please note that card/account holders traveling locally and not under an official travel authorization may use their GSA SmartPay® Travel card/account for local travel expenses only when expressly authorized by agency policy.

Next, fill out a Travel Authorization (TA), which serves as the official authorization to take the trip. The TA will need to be signed by your supervisor and routed for other necessary approvals. In order to complete the TA, please collect the following information:

Transportation Fares

- Airline: GSA negotiates special reduced rates with airline companies under the GSA City Pair Program (CPP).

- Privately-Owned Vehicles (POVs): Mileage rates for using POVs are updated annually.

- Train Transportation: Check with your Travel Management Company (TMC) for train transportation fares.

Lodging Expenses

- Daily lodging rates vary by time of year and location.

- State Tax Exemption: Depending on the type of account you are using and the state where you are traveling, your expenses may be tax exempt. If you are traveling to a state which does not grant tax exemption for your type of account, taxes are reimbursable by your agency. Before leaving for travel, visit the GSA SmartPay website or contact the state directly for tax exemption information and to obtain any state tax exemption forms, if required.

Meals and Incidental Expenses (M&IE)

- The per diem allowance for M&IE is reimbursable; however, rates vary based on location.

- On the first and last travel days, federal employees are only eligible for 75% of the total M&IE rate for their temporary duty travel location (not their official duty station location).

- The M&IE Breakdown shows the breakdown by meal for travel in the continental U.S.

Actual Expenses

- In situations where normal per diem rates are not sufficient to cover costs, actual expenses are allowable.

- This method of reimbursement must be approved ahead of time on your TA.

- Refer to Federal Travel Regulation (FTR) 301-11.303, Actual Expense for more information.

Training Event/Conference Attendance

- Special rates may apply for federal government attendance at training events/conferences.

- All fees must be indicated on your TA and approved ahead of time.

- Advance payment for a registration fee may be reimbursed as soon as your TA has been approved and after you have submitted the proper travel claim/voucher for the expenses incurred.

- Refer to FTR 301-74, Conference Planning for more information.

Let’s walk through an example of how to build a travel estimate using the tools provided in this training.

- Sam is stationed in Richmond, Virginia and has received an assignment requiring travel to Dover, Delaware in March 2023.

- Sam will drive to Delaware on Monday morning and will return on Friday afternoon. This requires four nights of lodging and five days of M&IE.

- Sam will be using his Individually Billed Account (IBA) travel card to pay for all travel-related expenses.

- Sam determines the per diem rate for his lodging and M&IE.

- For March 2023, the rates are $98 per night for lodging and $59 per day for M&IE for Delaware.

- Remembering that on the first and last travel day, federal employees are only eligible for 75% of the total M&IE for their temporary duty travel location, he notes that M&IE will only be $44.25 for his first and last travel days after viewing the M&IE Breakdown.

- Next, he visits the GSA SmartPay website and determines that IBA cards are tax exempt in Delaware.

- Sam downloads a copy of the required tax exemption form to take with him and makes note of the phone number for Delaware tax information.

- Next, he determines the mileage for use of his POV. For 2023, the mileage reimbursement rate per mile is $0.655. Sam estimates the distance to his destination at 204 miles and makes note that he receives mileage for both to and from his destination for a total of 408 miles.

- Finally, Sam has all the information he needs and is ready to calculate his totals.

| Expense | Amount | Total |

|---|---|---|

| Lodging | $98 x 4 nights | $392 |

| M&IE | ($59 x 3 days) + ($44.25 x 2 days) | $265.50 |

| Transportation (POV) | $0.655 x 408 miles | $267.24 |

| Actual | $0 | $0 |

| Training/Conference Fee | $0 | $0 |

| TOTAL | $924.74 |

Sam’s total trip expense estimate is $924.74.

Lesson 6: Making Reservations

What is the Travel Management System/Commercial Travel Office for airline, lodging and car rental?

As a federal government traveler on official travel, you are required to use the Travel Management System selected by your agency for all common carrier, lodging and car rental arrangements. Only the head of your agency or his/her designee may exempt certain types of travel arrangements from the mandatory use of the Travel Management System.

At most agencies, you will make travel reservations through your agency’s Travel Management Center (TMC) or Commercial Travel Office (CTO) if you work at the Department of Defense. The TMC/CTO may charge your agency a fee for processing the transaction. If there are several transactions, such as transportation and lodging reservations, the fee may be lower if you make all arrangements at the same time. Generally, the TMC/CTO pays for airline tickets using your agency’s travel CBA, so these charges will not appear on your GSA SmartPay® Individually Billed Account (IBA) Travel card/account. However, please check with your agency as some may require you to use your IBA travel card/account for airline tickets.

What are the benefits of the TMC/CTO?

There are several benefits to having the TMC/CTO make your reservations:

- Compliance with the Fly America Act, governmentwide travel policies, contract city pair fares, electronic ticketing and ticket delivery.

- Compliance with the Hotel/Motel Fire Safety Act.

- FedRooms consideration and benefits:

- Provides Federal Travel Regulation (FTR), Federal Emergency Management Agency (FEMA) and Americans with Disabilities Act (ADA) compliant hotel rooms for federal government travelers on official business.

- Customers receive benefits such as best price/value (at or below per diem), policy compliant hotels, flexibility when canceling, a variety of booking channels and quality lodging worldwide.

- Hotels are educated in state tax exempt policy and procedures.

For lodging reservations placed outside of FedRooms, make sure to ask:

- Is the facility on the FEMA list of fire safe lodging?

- What is the hotel’s cancellation policy? Be sure to cancel within the appropriate times if you will not be using the room. Most hotels charge for last minute cancellations or no-shows.

- What is the late arrival policy?

- When does the hotel charge your GSA SmartPay Travel card/account? This is important because it will affect your ability to receive timely reimbursement from your agency.

- Does the hotel honor the state tax exemption policy? Some states are tax exempt for GSA SmartPay Travel IBAs. If you are traveling to a state which does not grant tax exemptions, taxes are reimbursable. Before leaving for travel, make sure you know the tax exempt policy for your destination by checking the GSA SmartPay website.

For airline reservations:

- Use of City Pair fares is mandatory unless a valid exception is listed in the FTR 301-10.107.

- FTR requires that the more highly discounted “CA” fare be considered first and chosen if available and meets mission requirements.

- In order to obtain a refund for unused or partially used tickets, the traveler is responsible for contacting the travel agent, the TMC/CTO or airline (if tickets were purchased directly from the airline).

Lesson 7: The Week Before the Trip

What is a quick checklist to review to make sure that I’m ready for my trip?

Travel Checklist

When packing for your trip, don’t forget:

- Your government issued picture ID card/badge or driver’s license.

- A copy of your travel authorization.

- Your GSA SmartPay® Travel card/account to pay for official travel expenses.

- Personal cash or personal credit cards to pay for personal expenses.

- Lodging tax exempt forms, if required.

- A record of expenses – write down your expenses and save receipts. Lodging receipts are required by all agencies. Follow agency policy with regard to other receipts.

What are some examples of reimbursable and non-reimbursable expenses for my upcoming trip?

Reimbursable expenses

- Airfare and baggage fees.

- Maximum lodging amount allowed for the per diem locality excluding lodging tax.

- Meals (up to the rate for the per diem locality).

- Personal calls (per agency policy).

- Work related telephone calls and faxing.

- Laundry and dry cleaning (at the TDY location and only after consecutive nights lodging on official domestic travel).

- Car rental (approved).

- Shuttle, taxi and tips.

- ATM fees if allowed by your agency (cash advances for official travel only).

Non-reimbursable expenses

- Business or First Class airfares without prior written approval.

- Amount in excess of lodging amount allowed for the per diem locality unless previously approved.

- Meal costs over the rate for the per diem locality.

- Personal calls (per agency policy).

- Gifts and souvenirs.

- Postcards and postage.

- Personal expenses.

How do I get my airline tickets?

Most Travel Management Centers (TMC) or Commercial Travel Offices (CTO) use e-ticketing and will send your itinerary and ticket confirmation through email. With e-ticketing, you will not get a physical ticket, only information about the reservation. If your TMC/CTO mails airline tickets, pick up your ticket as close to the date of departure as possible.

Federal employees may retain, for personal use, frequent flyer miles earned while on official government travel.

Can I receive a cash advance?

In accordance with agency policy, you may obtain cash to cover all anticipated out-of-pocket cash expenses for the trip before you leave. The preferred and most efficient method to obtain a cash advance is by using your government travel card to withdraw cash from an ATM machine. As a reminder, do not withdraw cash for personal use.

Lesson 8: During Your Trip

What happens if my GSA SmartPay® Travel card/account doesn’t work?

If your GSA SmartPay Travel card/account does not work, there may be several possible reasons this may occur including:

- The transaction may be denied due to an authorization control such as a Merchant Category Code (MCC) block. An MCC is a four-digit code used to identify the type of business a merchant conducts (gas stations, restaurants, airlines, etc). The merchant chooses their MCC with their bank. Agency/organization program coordinators (A/OPCs) use MCCs to control what purchases are allowable. If your card/account does not work due to an MCC block, contact your program coordinator for advice or to get the block lifted. The bank cannot unblock a merchant category code or raise your credit limit without approval from your A/OPC.

- Your travel card/account may be suspended or canceled due to delinquent payment. If you recently paid the bill, it may not have been posted yet, or there may be other payment problems. Contact the bank’s customer service for advice. See the Resources page of this training for contact information for Citibank and U.S. Bank.

When should I use the ATM while on travel?

Use the ATM feature of your GSA SmartPay Travel card to obtain cash for official travel expenses authorized on your travel authorization. If you need assistance finding the nearest ATM, contact the bank’s customer service at the number on the back of your GSA SmartPay Travel card. If you lose or forget the PIN, you must apply for a new one and it will be mailed to the address provided at the time of application. Bank personnel are not able to look up the PIN for you. Your agency limits ATM use to a maximum dollar transaction over a specified period of time. Contact your A/OPC to find out your ATM limits.

Do not use the ATM with your GSA SmartPay Travel card to obtain cash for personal expenses.

What are ATM fees?

- The contractor bank may charge a minimal fee for ATM use.

- The fee amount is listed in your Account Holder Agreement and is reimbursable.

- The ATM machine you use may charge an additional fee. It will be posted on the receipt and is also reimbursable, if allowed by your agency.

Can I use the GSA SmartPay Travel card/account internationally?

- Your travel card/account may be used for official government international travel at any merchant who accepts Visa or Mastercard.

- You may obtain foreign currency from a bank or an ATM using the GSA SmartPay Travel card.

- Foreign currency transactions will be converted to U.S. dollars using a favorable conversion rate in existence at the time the transaction is processed. Processing may or may not take place on the date of the transaction and the rate may differ from day to day. The contractor bank shall not assess foreign currency conversion fees on purchases made in foreign currencies under the GSA SmartPay program and will identify the conversion rate and any other third-party fees related to foreign purchases charged on the statement.

- Some agencies offer Foreign Currency Accounts to card/account holders, where payment solutions are offered in foreign currencies. All administrative functions, including billing and settlement, shall occur in the foreign currency desired by the agency/organization.

Lesson 9: Returning from Your Trip

What are the next steps when I return home from official travel?

When you return from your trip, you will have to complete a Travel Voucher (TV) or a similar form at your agency to present your travel claim for expenses. Here are few key tips to remember:

- Within five business days of your return from official travel, complete and submit the TV.

- Provide all necessary information from your trip including receipts as required by your agency.

- Understand the sign-off process at your agency and follow-up to help speed your claim through the approval process.

- Set up direct deposit with your bank ahead of time to receive your reimbursement quickly. This way, you will not have to wait for a check to be mailed.

- Use the amount reimbursed by your agency to pay the statement in full by the payment due date. If you do not pay the balance on your travel account bill, it will become delinquent.

How do I pay my GSA SmartPay® Travel card/account bill?

- You will receive a statement notification, either electronically or through the mail, from the contractor bank once a month for your GSA SmartPay Travel card/account.

- The bill will be issued for all travelers in your office on the same date each month. This is called the billing cycle date.

- When you receive the statement, verify all of the charges listed.

- The full amount of undisputed transactions is due to the contractor bank by the payment due date indicated on the statement, whether or not you have been reimbursed by your agency.

- Please note that the GSA SmartPay Travel card is a charge card, and not a credit card. Therefore, no minimum payment can be made to keep the account from becoming delinquent. You must pay the full amount listed on the statement by the payment due date. If payment is not received in a timely manner, you may lose your charging privileges and adversely affect your ability to perform your job responsibilities.

- Payment may be made electronically, by mail or via mobile app as permitted by the agency.

- Please note that if you have no outstanding transactions for the billing cycle date, you will not receive an invoice. When all outstanding charges are paid, you will receive a statement the next month to reflect the payment.

What is split disbursement?

Split disbursement provides for payments to be made by the agency on behalf of the card/account holders. At the card/account holder’s direction and in accordance with agency policy, disbursement is split. The bank receives a direct payment by the agency of the card/account holder specified/claimed amount. The rest of the payment is disbursed to a card/account holder account or directly to the card/account holder. Large ticket items such as common carrier, hotel and rental car charges are commonly paid directly to the contractor bank on behalf of the card/account holder while other disbursements are paid to the employee.

Split disbursement is an effective tool to reduce delinquency and improve refunds paid to the agency. It will require coordination with the bank to ensure proper payments are made by the government and properly posted to a card/account holder’s account.

When is the payment due date?

Payment for all undisputed charges must be made in full by the payment due date, which is 25-30 days after the closing date on the statement (depending on the contractor bank). The payment due date is printed on each bill.

When is my card/account considered past due?

An account is considered past due if payment for the undisputed principal amount has not been received within 45 calendar days from the billing date.

Consequences of late payment include:

- Bank representatives will notify you.

- Your A/OPC is notified that the amount is past due.

- Your supervisor may also be notified.

What is salary offset?

The Travel and Transportation Reform Act of 1998 (Public Law 105-264) [PDF, 9 pages] mandates the use of the government contractor-issued travel card/account for all employees on official government business. The Act allows an agency to collect from an employee’s disposable pay any undisputed delinquent amounts that are owed to a contractor bank, upon written request from the contractor. This is known as salary offset.

Each agency must follow the due process requirements of the Act as presented in the Federal Travel Regulation (FTR) before collecting undisputed delinquent amounts on behalf of the contractor bank. Each agency must reach agreement with its bank on the process to be used for submission of the request and handling of the request internally.

Specific issues to be addressed by the agency include:

- Determining whether the individual is still employed by the agency.

- Determining whether the employee has been reimbursed for travel expenses.

- Determining the amount of disposable pay available for collection. Salary may be subject to other garnishments, etc.

- Payroll’s ability to process the request and provide a payment to the bank.

- Legal compliance with the terms of the Act.

- Union notification, if applicable.

A multifunctional team will be required to implement this process. Depending on your organization’s structure, this team would include the A/OPC and representatives from travel policy, payroll, human resources, labor relations and Office of the General Counsel. It is suggested that you work closely with your bank to establish a process that works for all parties.

Can my card/account be suspended if I don’t pay the bill?

Yes. A card/account may be suspended on the 61st calendar day from the billing date if payment of the full amount of undisputed charges is not received by the close of the 60th calendar day from the billing date in which the charge appeared. Consequences of suspension include:

- You will be unable to use the travel card/account.

- Bank representatives will notify you.

- Your A/OPC is notified that the card/account has been suspended.

- In many agencies, higher level officials are notified.

- The suspension will count toward the two suspensions, which will result in cancellation of the travel card/account when it becomes delinquent a third time.

When does card/account cancellation occur?

A card/account may be canceled if:

- It has been suspended two times during a 12-month period for undisputed amounts and is past due again.

- There is misuse on the travel card/account and the A/OPC has approved the cancellation.

- It is past due for undisputed amounts on the 126th calendar day from the billing date.

The A/OPC and/or GSA SmartPay Contracting Officer reserves the right to cancel an Individually Billed Account (IBA) under his/her purview and shall document the reasons for the cancellation.

What are the consequences of card/account cancellation?

Consequences include:

- You will be unable to use your travel card/account and it will not be reinstated.

- Your ability to do your job may be affected if you are not able to travel and obtain government discounts.

- The cancellation may be reported to your supervisor and to your human resources officer.

- The cancellation may result in a personnel action such as a notice or letter being placed in your official personnel record.

- The cancellation may be reported to credit bureaus and your personal credit rating may suffer.

- A late fee may be imposed on the uncollected balance.

- The contractor bank may begin collection actions.

- You will be liable for fees related to collection actions.

- The contractor bank may request a salary offset from your agency.

- At 180 calendar days past due, the bank writes-off the card/account as a bad debt and credit bureaus are again notified.

Is there a chart showing when cards/accounts may be suspended/canceled?

See below:

| Number Calendar Days | Account Status/Action |

|---|---|

| 46 days from the billing date | Pre-Suspension |

| 61 days from the billing date | Suspension/Pre-Cancellation |

| 126 days from the billing date | Cancellation |

| 180 days from the billing date | Charge-Off/Write-Off |

Please refer to your agency policy for specific delinquency stages as they may differ.

Lesson 10: How to Handle a Dispute

What is a dispute?

A dispute is a disagreement between the card/account holder and the merchant with respect to a transaction. Disputable charges include double billings and charges to your card/account that belong to another card/account. Non-disputable charges include sales tax, shipping, and returned or unused airline tickets. Usually, airline tickets are purchased by the Travel Management Company (TMC) using the centrally billed account (CBA) and the amount will never appear on your travel card/account. In the instance when you purchase airline tickets using your own individually billed account (IBA) and you return the tickets, the airline will issue a credit against your account. You, the card/account holder, are responsible for notifying the contractor bank of any items in dispute and will have 90 calendar days from the transaction date to initiate a dispute, unless otherwise specified by the agency/organization.

Payment of the undisputed charges must be made by the payment due date. Once you have submitted the dispute to the bank, delinquency of the disputed amount will be held in abeyance until the matter is resolved.

Please note that you relinquish your right to recover a disputed amount if you do not dispute it before 90 calendar days from the transaction date.

How do you handle questionable charges on the bill?

As a card/account holder, you are responsible for reviewing all charges on your statement. One of the first signs of fraud is at least one “mystery expense” showing up on your statement. Verify your statement by:

- Looking for transactions or account withdrawals that you do not recall making.

- Checking for unknown vendors.

If you do notice a questionable charge, act promptly so that you will have the necessary information before payment is due.

Contact the merchant for clarification on the charge.

- If you need help identifying the merchant, call the contractor bank’s customer service number listed on the back of your GSA SmartPay® Travel card/account.

- If the charge is erroneous, generally the merchant will reverse it, and it will appear as a credit on your next statement.

- Be sure to follow up and make sure the credit was posted to your account and deduct the credited amount from your payment.

- If the credit is not posted in a reasonable amount of time, dispute the charge with the bank.

- If the merchant says it is a legitimate charge to your card/account, ask for proof, such as a signed receipt.

- If, after receiving the additional information from the merchant, you do not agree that it is a legitimate charge, dispute the charge with the bank.

Lesson 11: Administration

How do I report a lost/stolen card?

Report a lost or stolen travel card promptly to:

- The contractor bank.

- Your A/OPC.

- Your supervisor.

Once a card has been reported as lost or stolen, the contractor bank immediately blocks that account from further usage and a new account number will be issued to the card/account holder.

Reporting the card as stolen does not relieve the card/card/account holder or the government of payment for any transactions that were made by the card/account holder prior to reporting it stolen. If you do not recognize a transaction appearing on your statement, you are responsible for notifying the contractor bank within 90 calendar days from the transaction date to initiate a dispute, unless otherwise specified by the agency/organization. This notification of transaction dispute may occur via the EAS, by telephone or other electronic means like email.

Please note that you relinquish your right to recover a disputed amount after 90 calendar days from the date that the transaction was processed. It is your responsibility to dispute questionable charges. If you don’t, you will be held personally liable for the amount of the questionable charge.

How do I renew my account?

Your GSA SmartPay® travel card/account is issued for a defined period of time and will expire.

- You do not need to initiate any action to get your account renewed.

- You will receive your new account before your current card/account expires.

- If you do not receive your new account, contact your A/OPC.

- If you possess a physical GSA SmartPay charge card, destroy the expired card; it does not need to be returned.

What happens if my name changes or my address changes?

Changes in information occur from time to time. Please be sure to contact the bank immediately with your new information by one of the following means:

- Calling the toll-free contractor bank number listed on the back of your card.

- Using the bank’s EAS.

- Asking your A/OPC to submit the change electronically.

Please also make sure to notify your local post office of your address change so that your mail will be forwarded.

When would my travel card/account be closed?

The GSA SmartPay Travel card/account must be closed when:

- You change jobs.

- You leave employment at the government.

- You change agencies.

Your agency has specific procedures on closing accounts. To close or transfer your account, notify your A/OPC. The A/OPC will contact the contractor bank to close your account.

Lesson 12: Misuse/Abuse and Fraud

What ethical standards apply to travel card/account holders?

Executive branch card/account holders are subject to the Standards of Official Conduct. These standards require that:

- Public service is a trust, requiring card/account holders to place loyalty to the Constitution, the laws and ethical principles above private gain.

- Card/account holders shall not use public office for private gain.

- Card/account holders shall satisfy in good faith their obligations as citizens, including all just financial obligations, especially those such as federal, state and local taxes, that are imposed by law.

What are some examples of misuse/abuse?

Misuse/abuse of the GSA SmartPay® Travel card/account can take many different forms, but here are some of the most common examples:

- Personal use.

- Use of the travel card/account for someone other than the specific card/account holder.

- Use while not on official government travel.

- Purchases from an unauthorized merchant.

- Excessive ATM withdrawals.

- Failure to pay undisputed amounts on time.

What are some consequences of misuse/abuse?

Consequences for misuse/abuse may include:

- Reprimand.

- Travel card/account cancellation.

- Counseling.

- Suspension of employment.

- Termination of employment.

- Criminal prosecution.

Please note that some agencies have agency-specific penalties and consequences for misuse/abuse of the travel card/account.

What is fraud?

Fraud is a deception deliberately practiced with the motive of securing unfair or unlawful gain. Fraud can be an attempt to cheat the federal government and corrupt its agents by using GSA SmartPay payment solutions for transactions not part of official government business. Like any deception, fraud has its fair share of victims.

Some of the different types of fraud include:

Skimming

Skimming occurs when a card/account holder’s data is stolen at the fuel pump, ATM or point-of-sale (POS) terminal.

Counterfeit Cards/Accounts

To make fake cards, criminals use the newest technology to “skim” information contained on magnetic stripes of cards.

Lost or Stolen Cards/Accounts

Often physical cards are stolen from a workplace, gym or unattended vehicle.

Card-Not-Present (CNP) Fraud

Internet fraud occurs whenever card/account information is stolen and used to make online purchases. Usually, a merchant will ask for the Card Verification Code (CVC) (located on the back of the card itself) to help prevent this type of fraud.

Phishing

Occurs whenever a card/account holder receives a fake email directing him or her to enter sensitive personal information on a phony website. The false website enables the criminal to steal information from the card/account holder.

Non-Receipt Fraud

Occurs whenever new or replacement cards are mailed and then stolen while in transit.

Identity Theft Fraud

Whenever a criminal applies for a card/account using another person’s identity and information.

What should card/account holders know about fraud?

As a card/account holder, you must:

- Be alert to the indicators of fraud (including false charges/transactions, mischarging, bribes, gratuities and kickbacks).

- Report suspected fraud immediately through the proper channels at your agency (AO, A/OPC, Financial Officer, Office of the Inspector General or Office of Special Investigations).

Furthermore, card/account holders should understand that any intentional use of the GSA SmartPay Travel card/account for other than official government business is considered an attempt to commit fraud against the U.S. Government and may be cause for disciplinary actions. The IBA card/account holder is held personally liable to the government for the amount of any non-government transaction.

Lesson 13: Approving and Certifying Officials

What is an Approving Official (AO)?

Specific to the purchase programs, the AO is an individual (typically a supervisor) responsible for ensuring that the purchase card/account is used properly by the agency. The AO also authorizes card/account holder purchases (for official use only) and ensures that the statements are reconciled and submitted to the Designated Billing Office (DBO) in a timely manner.

What is my role as an AO?

There are many important responsibilities entrusted to the AO, including:

- Ensuring that all purchases made by the card/account holder(s) within his/her span of control are appropriate and the charges are accurate. Purchases should not only be legal and proper, but also should be considered “mission essential”. In order to ensure proper purchases, the AO must review and approve card/account holder statements belonging to all card/account holders within their purview. The AO’s review should include looking at all required receipts and card/account holder logs.

- Counseling card/account holders within his/her span of control regarding regulations, misuse and delinquency.

- Resolving all questionable purchases with the card/account holder. Upon review of receipts and account-holder logs, if the AO finds a questionable purchase, they must work with the card/account holder to receive more information regarding the purchase in order to determine the legitimacy of the purchase.

- Elevating unresolved, questionable purchases to the agency/organization program coordinator (A/OPC). In the event an unauthorized purchase is detected or there is a purchase that is still in question after review of supporting card/account holder documentation, the AO must notify the A/OPC as well as any other appropriate personnel in accordance with agency policy. This may include notifying the agency’s Office of the Inspector General (OIG) for further investigation relating to potential misuse.

- Ensuring monthly billing account accuracy. The AO signs the account statement and maintains documentation regarding the account in accordance with agency procedures.

- Conducting informal compliance reviews for all card/account holders under their span of control. These reviews should be completed in accordance with the agency-specific policies (e.g., frequency, format).

- Assisting A/OPCs and card/account holders with their responsibility to obtain, maintain and retain complete documentation of all purchases.

Many agencies may provide additional responsibilities for the AO within their agency’s policies. It is important that the AO reviews the agency-specific policies before beginning their official duties.

Please note that AOs may be held financially responsible for payments made on accounts because of failure to ensure billing account accuracy. It is also important that the AO reviews the agency-specific policy regarding reimbursement and disciplinary actions.

What is a Certifying Official?

A Certifying Official is an individual who has been charged with the responsibility of authorizing certified vouchers for payment and ensuring that funds are available for obligation before payment. The Certifying Official is held accountable for verifying that payments made by the federal government are legal, proper and correct.

Please note that the OMB Circular A-123, Appendix B [PDF, 71 pages] and the GSA SmartPay® Master Contract language use the terms AO and Certifying Official synonymously. In the case of many agencies/organizations, the individual that holds the title of AO also holds the title of Certifying Official. However, the roles of AO and Certifying Official may be separate functions in some agencies/organizations.

What is my role as a Certifying Official?

United States Code Title 31 Section 3528 states the roles and responsibilities of a Certifying Official.

Certifying Officials are responsible for:

- Information stated in the certificate, voucher and supporting records.

- Computation of the certified voucher.

- The legality of the proposed payment under the appropriation or fund involved in the payment. In other words, the Certifying Official must make sure that the line of accounting that is utilized to pay the voucher aligns with the type of items purchased.

- Repaying a payment if the payment was certified and was illegal, improper or incorrect due to negligence on the part of the Certifying Official or was not paid out of the correct appropriation due to negligence on the part of the Certifying Official.

In the case of the purchase program, the Certifying Official will most often rely on other members of the Government Purchase Team (such as the card/account holder and the AO) to review the supporting records. However, the Certifying Official still has a responsibility to assess the accuracy of the data while performing the certification process and to report suspect transactions to the A/OPC and appropriate investigative office.

Many agencies may provide additional responsibilities for the Certifying Official within their agency’s policies. It is important that the Certifying Official reviews the agency-specific policies before beginning their official duties.

Lesson 14: SmartPay Resources

I’m a card/account holder with questions related to my specific account. How do I reach out to my agency’s contractor bank directly?

Citibank

- 800-790-7206 (within United States)

- 904-954-7850 (collect calls from outside United States)

- Citibank Online Account Access (self register, commercial site).

U.S. Bank

- 888-994-6722 (within United States)

Note: To speak with a live person, do not press any buttons. - 701-461-2232 (collect calls from outside United States)

- U.S. Bank Online Account Access (self register, commercial site).

Where am I able to access the GSA SmartPay® Master Contract?

The terms and conditions of the Master Contract identify specific contractual requirements that the GSA SmartPay program has with the contracting banks.

The GSA SmartPay Master Contract can be viewed on the GSA SmartPay website. Download a copy and review relevant clauses and sections that pertain to the GSA SmartPay Travel program, as well as to the GSA SmartPay program in general.