Card/Account Holders and Approving Officials Travel Training

Lesson 1: Travel Program Overview

What is the GSA SmartPay® program?

Established in 1998, the GSA SmartPay program is the world’s largest government charge card and commercial payment solutions program, providing services to more than 250 federal agencies/organizations and Native American tribal governments with 4.5 million total accounts. GSA SmartPay payment solutions enable authorized government employees to make purchases on behalf of the federal government in support of their agency’s mission. The GSA SmartPay program includes the following business lines:

- GSA SmartPay Purchase.

- GSA SmartPay Travel.

- GSA SmartPay Fleet.

- GSA SmartPay Integrated.

Through the Master Contract with multiple banks, the GSA SmartPay program enables agencies/organizations across the federal government to obtain payment solutions to support mission needs. The Master Contract, administered by GSA, is a fixed price, indefinite delivery, indefinite quantity (IDIQ) contract. The maximum base period for the initial order is four years with three, three-year options.

Agencies/organizations issue a task order under the GSA SmartPay 3 Master Contract to one of the GSA SmartPay contractor banks – Citibank or U.S. Bank. Then, the awarded bank provides payment solutions to the agency.

Through the task order, your agency/organization program coordinator (A/OPC) sets up accounts for the card/account holders, manages the accounts using the bank’s Electronic Access System (EAS), and resolves issues or questions by working directly with a bank representative.

Specific to travel, the GSA SmartPay program provides card/account holders with a means to pay for all travel and travel-related expenses. Additionally, the GSA SmartPay program is the primary mechanism used to purchase airline, rail, and bus tickets at significantly reduced fares under the GSA City Pair Program (CPP).

What are the benefits to using the GSA SmartPay Master Contract for obtaining payment services?

The GSA SmartPay program has continued to grow through increased adoption as agencies/organizations realize benefits afforded under the program.

Utilizing the GSA SmartPay Master Contract means:

- A faster contract acquisition process and reduced risk of protest, as compared with a full and open competitive procurement.

- Favorable negotiating platform and contract terms.

- Awards to contractor banks based on a competitive bidding process.

- Established relationships with contractor banks.

- A broad range of flexible products and services for agencies/organizations as well as the flexibility to add products and services.

- Ongoing support for your agency/organization.

What are some of the overall benefits to using the GSA SmartPay program?

Agency Refunds

Agencies have the opportunity to earn refunds based on the dollar volume of transactions and the speed of payment.

Safety and Transparency

The GSA SmartPay program provides secure solutions for efficient payment transactions. Customers also have access to tools that provide increased transparency for spend and performance data.

Electronic Access to Data

Through the GSA SmartPay contractor bank’s electronic access system (EAS), account managers and card/account holders have immediate access to complete transaction-level data, helping to mitigate fraud, waste, and abuse.

Worldwide Acceptance

Through the use of commercial payment infrastructure, customers are able to use GSA SmartPay solutions anywhere in the world where merchants accept cards.

Identification for Discount Programs

GSA SmartPay solutions provide automatic point-of-sale recognition for many GSA discount programs, including Federal Strategic Sourcing Initiative (FSSI), the GSA City Pair Program (CPP), and more.

Other Benefits

GSA SmartPay payment solutions provide other less tangible benefits including travel insurance and eliminating the need for imprest funds or petty cash at the agency.

Why does the U.S. Government have a travel payment solutions program?

The Travel and Transportation Reform Act of 1998 (Public Law 105-264) [PDF, 9 pages] mandates that federal government card/account holders use the travel card/account for official government travel expenses. Additionally, the Federal Travel Regulation (FTR) mandates use of the travel card/account in almost all cases (see FTR Subpart H §301-70.700 for exemptions). The travel card/account allows individual card/account holders to pay for travel expenses and receive cash advances. In many instances, use of the travel/card account eliminated the need for agencies to issue travel cash advances. Government card/account usage provides streamlined, best-practice processes that are consistent with private industry standards.

What are some types of GSA SmartPay Travel cards/accounts?

Individually Billed Accounts (IBAs)

- Most common travel card/account.

- Issued to an employee designated by the agency/organization in the employee’s name.

- Used to pay for official travel and travel-related expenses.

- Only issued to federal employees or employees of tribes or tribal organizations.

- May be used for local travel only if authorized by written policy of the agency/organization.

- Agencies/organizations reimburse employees only for authorized and allowable expenses.

- Card/account holders are directly responsible for all purchases charged to the IBA account.

- Payment may be made directly by the card/account holder, agency/organization or in the form of a split disbursement in accordance with agency/organization policy.

Centrally Billed Accounts (CBAs)

- Established by the bank at the request of the agency/organization to pay for official travel charges and official travel-related expenses.

- Generally used to purchase common carrier transportation tickets for employee official travel through third-party arrangements, such as the GSA E-Gov Travel Service (ETS) for civilian agencies, the Defense Travel System (DTS) for the Department of Defense or permissible equivalent travel system.

- Agencies/organizations may also make purchases through their Travel Management Centers (TMCs), commercial travel offices and through other government contracts.

- Agency is directly billed and is liable for making the payment.

- Payment is made directly to the bank by the government.

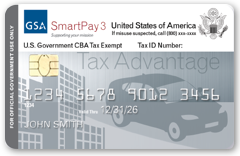

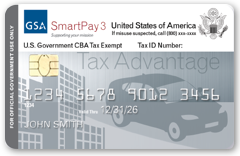

Tax Advantage Travel Accounts

- Issued to an employee designated by the agency/organization in the employee’s name.

- Used to pay for travel and travel-related expenses.

- Combines IBA and CBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses.

- Charges for rental cars and lodging will be automatically billed to a CBA for payment, taking advantage of the government’s CBA tax exemption status for those types of accounts.

- Charges for other travel-related purchases, such as meals and incidentals, are billed to the IBA portion of the account and will still incur tax. The individual traveler will still be liable for payment to the bank for those charges.

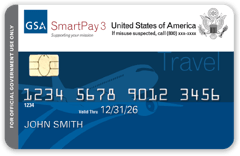

How do I recognize GSA SmartPay Travel cards/accounts?

Typically, travel cards have one of these designs:

Please note that card designs may vary.

GSA SmartPay Travel cards/accounts use the following prefixes:

| Brand | Card Prefix |

|---|---|

| Mastercard | 5565, 5568 |

| Visa | 4486, 4614, 4615, 4716 |

For the travel business line only, the sixth digit will identify whether the account is a CBA or IBA.

| Account Type | Sixth Digit | Billing Type |

|---|---|---|

| 1, 2, 3, 4 | IBA |

| 6, 7, 8, 9, 0 | CBA |

| 5 | CBA/IBA |

Why is it important to understand your travel card/account type?

Tax exemption and liability differ depending on the travel card/account type.

Tax exemption considerations

- All GSA SmartPay CBAs should be exempt from state taxes.

- Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states.

- Card/account holders should review and understand the state tax policy for the state where you will be traveling to and should make sure to have all necessary forms before traveling.

Liability considerations

IBA Accounts

- Liability for charges on the IBA rests with the individual card/account holder, not with the agency/organization.

- If the card/account holder fails to pay his/her account on a timely basis, the bank may suspend or cancel the account and assess late charges and fees.

- If the bank cancels an account due to delinquency, the bank may report that information to credit bureaus and the information will appear on the card/account holder’s personal credit report.

- The bank can pursue debt collection to obtain repayment of the charges.

- The agency/organization is never responsible or legally liable for the account.

CBA Accounts

- Liability for charges on the CBA rests with the agency/organization, not with the individual card/account holder.

Tax Advantage Travel Accounts

- Because the account is a combination of both CBA and IBA, the liability will be determined by the type of purchase.

- If it is a CBA purchase, the liability rests with the government.

- If it is an IBA purchase, the liability rests with the card/account holder.

How would someone check tax exemption status?

Here is a typical example of how to check tax exemption status:

- Jo is planning an official government trip to the GSA SmartPay Training Forum in Orlando, Florida.

- During the planning stages for the trip, she checks the GSA SmartPay website to find out more information about tax exemption in Florida.

- Jo learns that IBA travel cards/accounts are tax exempt in Florida. In addition, while no form is required, Florida does allow hotels to require a “Certificate of Exemption”. She also saved the Florida Department of Revenue’s phone number in case any questions came up during her trip.

- Jo confirms that she has a GSA SmartPay IBA travel card/account – the first four digits are “4486” and the 6th digit is a “4”.

- Jo books the hotel room and follows up with a call to verify that the hotel is compliant with the state’s tax exemption policy. If not, she’s given herself plenty of time to find another hotel that does comply.

Back